Why the Space Force Needs More Options.

With U.S. military operations dependent on capabilities and effects delivered from space, ensuring continued access to the orbital domain requires a robust and reliable launch infrastructure as foundational to sustaining space superiority.

Despite a historic launch rate and multiple potential launch providers, America’s National Security Space Launch (NSSL) capabilities are less robust than they should be. USSF can help reach its launch goals by diversifying launch providers, increasing launch sites, and investing in research and development for rocket technology, all while actively monitoring the launch supply chain. These efforts should be a national priority.

“For our service, space superiority is the first core function,” Chief of Space Operations Gen B. Chance Saltzman said earlier this year at the Mitchell Institute Spacepower Security Forum. “It is the ability to contest and, when necessary, control the space domain at the time and place of our choosing.”

Col. Charles Galbreath, USSF (Ret.), is a Senior Fellow for Space Studies at the Mitchell Institute Spacepower Advantage Center of Excellence.

At the most fundamental level, this requires the Space Force to have assured access to space. The Space Force must retain a diverse stable of launch providers, while expanding options for launch locations to ensure that, in the event of natural or man-made disasters, access to space is never compromised, and it must continue to invest in new technologies and a healthy space technology supply chain.

To have a war-winning space architecture, the United States must have a war-winning launch infrastructure. Unfortunately despite multiple potential launch providers, the United States currently has just one certified provider—SpaceX—for medium and heavy national security space launch missions. This invites unnecessary risk.

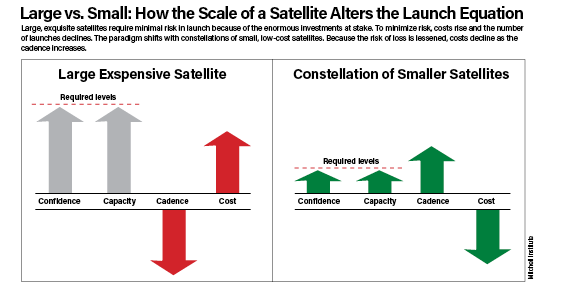

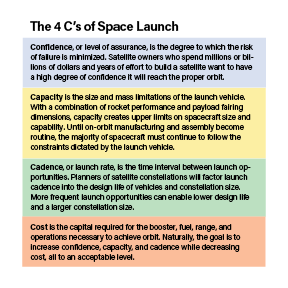

The United States’ has the on-orbit architecture it does because of available launch capabilities, especially when it comes to four key factors: confidence, capacity, cadence, and cost. There is tremendous interplay between these variables.

To better understand how these factors interact, consider an example that starts with a notional large, billion-dollar satellite that took 10-plus years to design and manufacture. Such an investment heightens the importance of confidence and capacity when it comes to launch; in the face of such risk, increases in cost are acceptable to achieve greater size and mission assurance. Greater risk could increase the time needed to prepare the launch vehicle and to reduce the risk of failure, which, in turn, could decrease the cadence of follow-on launches. While acceptable for a one-of-a-kind satellite, such an approach could preclude the timely launch of a large constellation.

Consider next a large constellation of smaller, less costly satellites. The calculus shifts. Here, the focus is on decreasing cost and increasing cadence because the risk of any individual launch is only a fraction of the total needed. With smaller satellites, the available launch options increase, as do the potential locations. This is because a large constellation of small satellites is only feasible if launch capabilities can sustain a cadence high enough and costs low enough to make the concept viable.

Now consider the relationship between confidence and cadence. It is a given that launches occasionally experience technical failure—some have even joked that “launch vehicles are the greatest natural predators to satellites.” Even successful launch providers suffer technical issues. Case in point: After over 300 successful launches, a SpaceX Falcon 9 rocket failed in July 2024, sending 20 Starlink satellites into an unusable, shallow orbit. The failure halted Falcon 9 operations for a month as crews researched the root cause and took corrective action. Similar delays have had even farther-reaching impact: The Space Shuttle program stood down for two years and eight months after the Challenger disaster and two years and five months after its second accident, when Columbia was destroyed on reentry. While these extended delays were driven by safety concerns related to human spaceflight, they clearly illustrate the fundamental relationship between confidence and cadence.

Notably, concerns about safety are not equal for all nations. While the United States values flight safety over cadence, its nearest launch competitor, China, does not. With four land-based and one sea-based launch site and a dozen variants of the Long March rocket, China boasts an impressive launch capability, but its satellites generate greater orbital debris, and many of its launch flight profiles travel over populated areas. China conducted 67 launches in 2023 and plans for 100 in 2024, according to published reports. In one recent launch that Chinese officials deemed a “complete success,” debris rained down on a village. In the first launch of a proliferated low-Earth orbit (pLEO) constellation in August 2024, a Chinese booster crumbled, casting more than 700 pieces of debris into space. In both cases, China continued to press forward rather than pause to correct an issue that, while messy, still managed to deliver the payload into orbit. China is more intent on becoming a space leader than in being mindful of space debris.

This mindset suggests a potential fifth factor: The criticality placed by China on becoming a leader in space overrides other factors. The United States had a similar mindset in the early days of the Space Race in the 1950s and ’60s. Establishing on-orbit capability in the race against the Soviet Union was a powerful motivator, driving the U.S. to persist in the face of multiple failures and great costs. The USSF today could similarly adopt a more aggressive approach and accept some inevitable failures as progress toward success. The safety concerns applied to missions carrying astronauts are not the same as those for satellites only, and clearly, some can tolerate greater risk than others. Considering the stakes in today’s space race, the United States should be willing to accept responsible risk for launch, given that the consequence of ceding space superiority to China would be catastrophic.

Historical Context

At the beginning of the Space Age, the United States adapted rockets developed as intercontinental ballistic missiles (ICBMs) to the duties of space launch. Systems like Atlas, Thor, and Titan were designed as ICBMs and converted into launch vehicles. (This was not the case for the Saturn IIB and Saturn V rockets used in the Apollo program). NASA developed the space shuttle in the 1970s, but not until the 1990s did Air Force Space Command develop a new class of evolved expendable launch vehicles (EELVs), which culminated in the Atlas V in 2002 and Delta IV in 2004. Lockheed Martin developed the Atlas V and Boeing the Delta IV before the two created the joint venture United Launch Alliance (ULA), which took over launch operations for both vehicles in 2006 to reduce overhead. Those systems provided the military’s primary access to space until the mid-2010s, though other options, such as the Minotaur launch vehicle, which uses a Minuteman Missile as a first stage, were also available. Importantly, all of these launch designs were one-time-use systems—a key factor driving high launch costs.

The desire to lower cost and boost cadence leads many to pursue reusability. Concepts include reusable first stages, upper stages, and fully reusable systems. Results yielded varying degrees of success. From 1981 to 2011, the space shuttle was powered by reusable solid rocket boosters and orbiters. The air-launched Pegasus rocket effectively uses an aircraft as a reusable first stage. The Space Force’s X-37B Orbital Test Vehicle is basically a reusable upper stage.

The current standard for reusability is SpaceX’s Falcon 9 and Falcon Heavy, with reusable first-stage boosters. These vehicles have achieved significant decreases in cost and increased cadence. SpaceX is now pursuing a fully reusable superheavy launch vehicle, Starship, flown from Texas.

Regardless of the launch vehicle technology, the launch range is also a significant factor. U.S. geography enables over-ocean launches from both the East and West Coasts. The Eastern Range, located at Patrick Space Force Base, Fla., is the busiest U.S. range, with 72 orbital launches in 2023 and a projected 111 missions in 2024. The Western Range at Vandenberg Space Force Base, Calif., conducted 30 launches in 2023, with 34 planned in 2024. Launches from the Eastern Range use the Earth’s rotation to gain a velocity boost; launching from the Western Range enables better access to polar orbits.

Weather is a limiting factor at both locations, with frequent tropical storms on the East Coast and low-visibility fog on the West Coast, both hampering cadence. From 1990 to 2008, weather caused an average of 21 launch delays annually at Kennedy Space Center on the Eastern Range.

State of Modern Launch

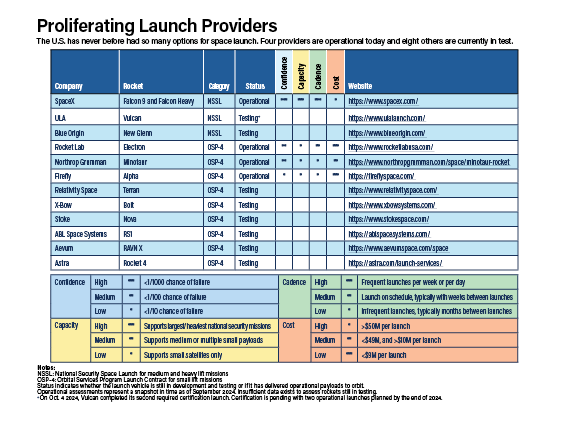

The current Space Force launch capability falls under two main programs: National Security Space Launch (NSSL) and Orbital Services Program contract (OSP-4). NSSL, formerly the EELV program, is now in its third phase and has contracted SpaceX, United Launch Alliance (ULA), and Blue Origin. SpaceX operates the Falcon 9 and Falcon Heavy, while ULA and Blue Origin are bringing on new rockets. ULA’s Vulcan, an expendable rocket, had its first launch in January 2024, carrying a commercial lunar lander as a payload. Blue Origin’s New Glenn, a reusable design, is scheduled for its first launch in late 2024. ULA’s Vulcan uses two BE-4 engines, and Blue Origin’s New Glenn uses seven BE-4s.

To foster innovation and reduce cost, the NSSL established two tailored levels of mission assurance: a lower-cost level for missions that can accept higher risk and a higher-cost option for risk-averse missions.

OSP-4 has more options, supporting small launch vehicles at alternative launch sites. Intended for rapid launches of payloads as small as 400 pounds, it has a dozen companies under contract: Blue Origin, Stoke, ABL Space Systems, Aevum, Astra, Firefly, Northrop Grumman, Relativity Space, Rocket Lab, SpaceX, ULA, and X-Bow. Some are already demonstrating successful launches, while others have yet to achieve their first launch. The smaller class of booster enables launch operations from diverse locations, including Wallops Island, Va., and Kodiak, Alaska.

With so many providers today, the state of U.S. launch appears solid. But the reality is far more complex. Launch is literally “rocket science.” Early failures in development are common, and catastrophic failures are always possible, potentially causing downstream ripple delays across multiple launch systems. Constant attention and investment are required to ensure the necessary levels of confidence, capacity, and cadence for U.S. space launch to deliver the on-orbit architecture the Space Force needs to deter conflict in the future—or win if deterrence fails.

Of the 12 launch providers on the OSP-4 and NSSL contracts, only four are currently placing operational payloads in orbit and only one is certified for National Security Space Launch missions.

Evaluating these four against the metrics of confidence, capacity, cadence, and costs makes clear that the robust launch infrastructure necessary to support a war-winning on-orbit architecture is not yet in place. To have a resilient team of providers capable of meeting the dynamic launch requirements, rather than a single provider fully addressing all the factors itself, is crucial to the long-term competitiveness of the U.S. military space program.

Recommendations

Continue to Increase Launch Provider Diversification: Despite having three providers in NSSL and 12 in OSP-4, more launch providers are needed. Because the Vulcan and New Glenn are new boosters, challenges will likely emerge through continued testing and operations. Reliance on the same rocket engine for both raises concerns that problems with one could ground both; the fact that only six of 12 OSP-4 providers have conducted successful launches is also a concern.

By continuing to pursue multiple launch providers, the Space Force can increase confidence and cadence to meet the resulting demand. Alternate providers should also expand supply chains and diversify manufacturing processes, reducing the risk that one failure grounds all or most space launches.

Naturally, depending on the size and weight of a satellite, multiple launch providers may be able to offer the required capacity and cadence. If this is the case, satellite owners seeking to place multiple vehicles in orbit could leverage a diverse set of providers, increasing launch cadence over what is possible with a single provider.

Diversifying providers will also drive competitive pricing, pushing down costs. Competition encourages partnership and innovation, paying off for the customer. Novel approaches to launch processing and vehicle development can also lead to decreased costs.

Diversify Launch Sites: With two primary launch locations for most NSSL missions and two for smaller launches, members of the House Armed Services Committee are calling for greater launch site flexibility. They worry that an earthquake in California or a hurricane in Florida could severely impact the nation’s access to space. Similarly, having just two major launch sites poses a risk in case of conflict with a near-peer, as an adversary might target the few launch complexes on which the nation depends. Risk mitigation measures, including emergency response and security, can help, but a greater number of launch sites is essential. Just as a proliferated on-orbit architecture increases resilience, so too would a more diverse set of launch sites ensure a resilient launch capability.

Perhaps most importantly, adding alternate launch sites would enable the U.S. to increase its launch cadence. Dispersed parallel processing and launch would reduce bottlenecks at single-digit launch pads. As confidence in the reliability of launch vehicles grows, additional flight paths over land could also augment operations at existing sites.

Invest in Rocket Research and Development: Achieving the next plateau of launch capability requires continual R&D, and breakthroughs in technologies and operational concepts require stable, continuous funding.

Two prime areas stand out for further development:

- Computer design and material manufacturing have started to transform the launch and space industry but are still in their initial stages. Additional advancement will promote design and assembly process innovation that can simultaneously increase confidence and decrease cost. Additional investments focusing on manufacturing to improve cadence and cost are needed; digital design can provide greater insight and modeling, speeding up certifications.

Monitor and Diversify the Supply Chain: Even with launch provider diversification, there are common components and materials. Ensuring quality is an integral part of launch mission assurance. Government and independent third-party pedigree reviews and acceptance testing are common practices. Supply chain issues, such as quality breaches or low availability, become harder to track and manage when those reviews are waived. Timely delivery at a tempo to meet the required launch cadence is crucial. By maintaining a higher level of insight, the government can interject and provide corrective actions to avoid potential supply chain issues from derailing the nation’s assured access to space.

Conclusion

Space launch and the assured access to space that it represents are foundational to shaping and delivering the United States’ space architecture. For the Space Force, having the right confidence, capacity, cadence, and cost in its launch enterprise is a prerequisite for space superiority and maintaining a distinct space advantage over competitor nations.

Space launch remains a technically challenging and often risky venture. The Space Force must retain a diverse set of launch providers, expand options for launch locations, continue to invest in rocket R&D, and maintain awareness of potentially crippling supply chain issues. Providing the Space Force with the resources and personnel to accomplish these recommendations should be a national priority. Failure to do so risks not just space launch but the entire set of space capabilities and services upon which the nation relies.